Predicting BTC Price for 2025

Introduction to Bitcoin

Bitcoin is a revolutionary digital asset that has reshaped the financial world since it was launched. As a pioneering decentralized cryptocurrency, Bitcoin operates on a peer-to-peer network, sidestepping traditional banking systems and central authorities. This unique structure makes Bitcoin a groundbreaking innovation in the realm of digital currencies. The finite supply of Bitcoin, capped at 21 million coins, further adds to its allure, creating a scarcity that appeals to investors and tech aficionados.

The creation of Bitcoin was a response to the global financial crisis of 2008, aiming to offer an alternative form of currency that was independent of any central control. Its underlying technology, blockchain, ensures that transactions are transparent, secure, and immutable, setting a new standard for digital transactions. Blockchain technology has also inspired the creation of numerous other cryptocurrencies and applications beyond the financial sector.

Bitcoin has evolved from a niche interest to a widely recognized financial instrument. Its adoption has been fueled by a combination of technological innovation, investor interest, and broader acceptance of digital assets. Bitcoin’s journey has been marked by its price volatility, which has both intrigued and deterred potential investors. Despite these fluctuations, Bitcoin continues to gain traction as both a store of value and a medium of exchange.

In recent years, platforms like Binance have played a crucial role in democratizing access to Bitcoin. By providing a user-friendly interface and a secure trading environment, Binance has enabled a broader audience to participate in the Bitcoin market. This increased accessibility has contributed to the growth of Bitcoin’s user base and trading volume, further solidifying its position in the financial ecosystem.

Bitcoin’s decentralized nature means it is not subject to the whims of a single entity or government, offering a level of financial sovereignty that is attractive to many. This characteristic is particularly appealing in regions with unstable economies or where access to traditional banking is limited. Bitcoin provides a viable alternative for transferring value across borders, offering a more inclusive financial system.

The growing institutional interest in Bitcoin has also played a significant role in its mainstream acceptance. Financial institutions, hedge funds, and publicly traded companies have begun to allocate portions of their portfolios to Bitcoin, recognizing its potential as a long-term investment. This institutional adoption has brought a new level of credibility to Bitcoin, attracting further interest from retail investors.

Bitcoin’s deflationary nature, due to its capped supply, contrasts sharply with the inflationary tendencies of traditional fiat currencies. This characteristic has led some to view Bitcoin as “digital gold,” a modern hedge against economic instability and currency devaluation. As concerns about inflation and fiscal policies continue to rise, Bitcoin’s role as a potential safe haven asset becomes increasingly relevant.

The regulatory environment surrounding Bitcoin is continually evolving. Governments and regulatory bodies are grappling with how to classify and manage this new asset class. While regulatory clarity can boost investor confidence, overly stringent regulations could hinder innovation and adoption. Navigating this regulatory landscape will be crucial for Bitcoin’s continued growth and acceptance.

Bitcoin has also sparked a cultural shift, inspiring a movement towards greater financial independence and self-sovereignty. The ability to control one’s assets without relying on traditional financial institutions resonates with a growing number of people. This cultural shift is evident in the increasing number of businesses accepting Bitcoin as payment and the development of infrastructure to support its use in everyday transactions.

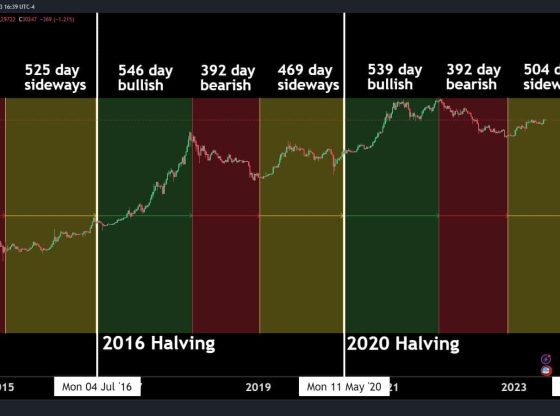

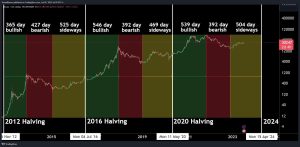

The upcoming Bitcoin halving event, set for 2024, is another milestone that could impact its price dynamics. Historically, halving events have reduced the rate at which new Bitcoins are introduced into circulation, creating a supply shock that often leads to price increases. This anticipated event is likely to attract significant attention from both current investors and those considering entering the market.

Bitcoin’s impact extends beyond its immediate financial implications. It has spurred the development of a broader ecosystem of digital assets and blockchain-based applications. Innovations such as smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) have their roots in the foundational technology introduced by Bitcoin. This burgeoning ecosystem continues to expand, offering new opportunities and challenges for developers, investors, and regulators alike.

As Bitcoin continues to mature, it remains a focal point of discussions about the future of money and the digital economy. Its influence on financial markets, technology, and culture is undeniable, making it a subject of ongoing interest and debate.

Recent Bitcoin Trends

Bitcoin’s price has seen notable changes recently, illustrating the volatile nature of cryptocurrencies. Analyzing BTC price movements shows that Bitcoin has experienced significant growth phases, punctuated by multiple bull runs and periods of correction. These fluctuations highlight Bitcoin’s dual role as a store of value and a speculative asset.

Various elements have contributed to the current pricing of Bitcoin. The growing acceptance of BTC as a legitimate investment by institutional players has been a crucial factor driving its price upward. Large financial entities, such as hedge funds and publicly traded companies, have added Bitcoin to their portfolios, boosting its credibility and demand.

Macroeconomic factors, like concerns about inflation and the depreciation of traditional currencies, have also influenced Bitcoin’s valuation. Investors looking to hedge against inflationary trends have increasingly turned to Bitcoin, appreciating its limited supply and deflationary characteristics. However, the inherent volatility of Bitcoin continues to be a point of contention. Critics argue that this volatility could significantly impact its price trajectory in the coming years, with investors potentially viewing Bitcoin more like a high-risk stock than a stable store of value. [ Critics argue that its volatility could play a significant role in shaping its price trajectory in 2024, as investors might perceive Bitcoin more like a stock market investment rather than a stable store of value.](https://www.statista.com/topics/2308/bitcoin/)

The influence of social media and public perception cannot be underestimated. High-profile endorsements and criticisms from influential figures can sway investor sentiment, causing rapid price movements. For instance, tweets and public statements from celebrities and industry leaders have been known to trigger significant price spikes or drops.

Technological advancements and network developments also play a role in shaping Bitcoin’s price. Improvements in blockchain technology, scalability solutions, and enhancements to security measures can increase user confidence and adoption, potentially driving up the price. Conversely, technical challenges or security breaches can lead to market sell-offs and price declines.

The emergence of new financial products, such as Bitcoin futures and exchange-traded funds (ETFs), has further integrated Bitcoin into mainstream financial markets. These instruments allow for more sophisticated trading strategies and greater market participation, influencing BTC price dynamics. The approval and launch of Bitcoin ETFs, in particular, have been pivotal moments, often correlating with increased market activity and price appreciation.

Mining activities and their associated costs are another factor impacting Bitcoin’s price. The energy-intensive process of mining, along with fluctuations in electricity costs and mining hardware efficiency, can affect the profitability of mining operations. Changes in mining profitability can influence the supply of newly mined Bitcoins, thereby impacting the market.

Global economic events and geopolitical tensions also play a crucial role in Bitcoin’s price trends. Economic instability or uncertainty in traditional financial markets often drives investors to seek alternative assets like Bitcoin. For instance, during periods of economic downturn or political unrest, Bitcoin has sometimes seen increased demand as a perceived safe haven.

Regulatory developments around the world continue to shape the Bitcoin landscape. Governments and regulatory bodies are actively working to define frameworks for the use and trading of cryptocurrencies. Positive regulatory developments can enhance investor confidence and drive adoption, while negative or restrictive regulations can hinder market growth and innovation.

Environmental concerns related to Bitcoin mining have also gained attention. The high energy consumption associated with Bitcoin mining has sparked debates about its sustainability. Efforts to transition to renewable energy sources and improve mining efficiency are ongoing and may influence public perception and adoption.

Lastly, the broader cryptocurrency market dynamics, including the performance of altcoins and other digital assets, can impact Bitcoin’s price. Bitcoin often serves as a benchmark for the cryptocurrency market, and trends in the broader market can have a ripple effect on its valuation. The interplay between Bitcoin and other digital assets creates a complex market environment that can lead to rapid changes in price.

Bitcoin’s price trends are influenced by a multitude of factors, ranging from institutional adoption and technological advancements to macroeconomic conditions and regulatory developments. The interplay of these elements creates a dynamic and often unpredictable market landscape, making Bitcoin a subject of ongoing interest and analysis.